Australian Homeowner Equity Fund

A diversified residential property investments fund to provide shared equity allocations for everyday Australians aspiring to own and live in their own property.

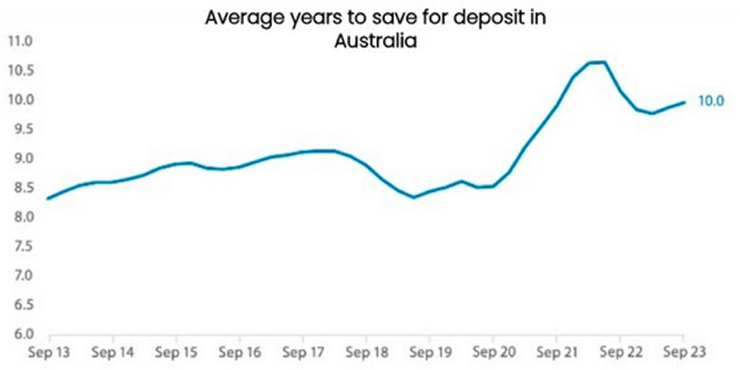

WHY? 10 years to save for a home deposit!

The average time for Australians to save a 20% deposit for a home is approximately 10 years, highlighting a significant barrier to homeownership.

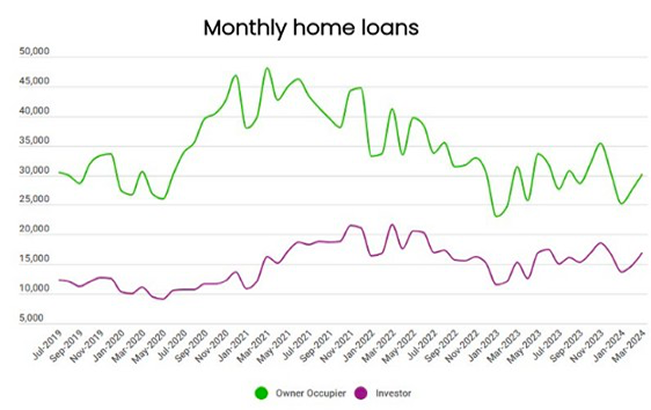

However, demand for home loans is high

With 25,000 new home loans issued monthly, the demand for mortgage services remains robust.

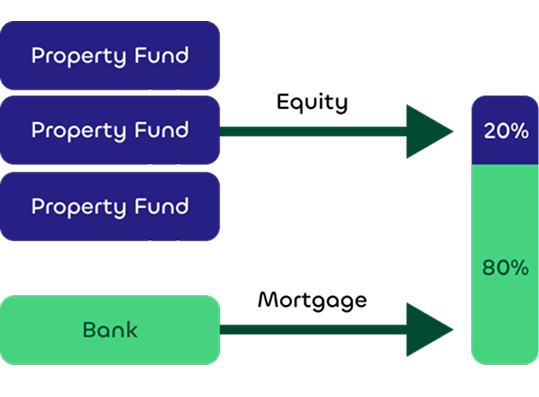

The solution is shared equity – investors own 20%, bank loan 80%

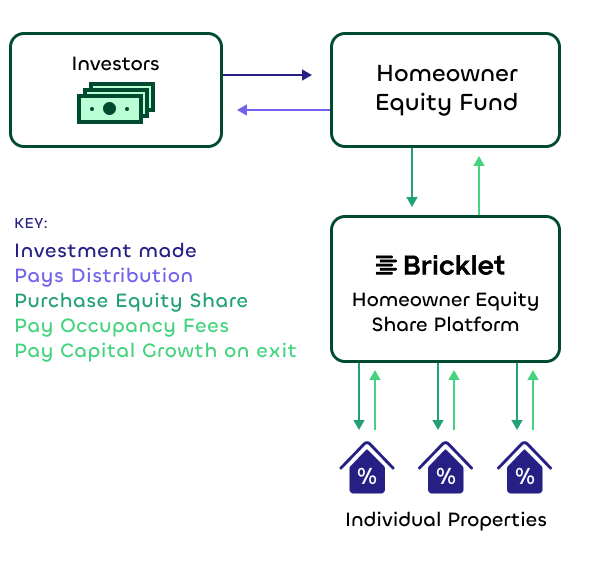

With the first bank partnership with AMP Bank, Bricklet’s Homeowner platform enables buyers without a 20% deposit who have high income to purchase their home. The Bank provides the home loan, while investors contribute to the deposit and receive an equity stake. Buyers make mortgage payments to the bank and an occupancy fee to the investor. Homeowners can buy out the investor’s equity at any time or sell the property. This model addresses the barrier of upfront costs, allowing buyers to enter the property market sooner.

The Bricklet Homeowner Shared Equity Program is helping those with high income and low deposit to achieve their dream of home ownership

Who can we help?

Census data shows over 1 million individuals with annual incomes exceeding $150,000, indicating a substantial pool of potential participants with the financial capacity for homeownership but hindered by the challenge of accumulating a large deposit.

How can we reach that many people?

There are over 19,000 Mortgage brokers in Australia and Bricklet has immediate access to over 10,000 of those mortgage brokers via the AMP Bank partnership.

The average first home buyer home loan deposit is $159,000.

This has increased by more than 50% since 2020, according to the National Housing Finance and Investment Corporation.

Every $1mil of equity deployed = 6 new homeowners

- Property funds provide equity share

- Banks provide mortgage

- Bricklet provides a platform and marketplace

Income is derived from occupancy fees paid monthly by the homeowner and capital growth from the portfolio of shared equity interests in residential property.

- Equitable interest secured by co-ownership deed, caveat and APCOR register.

- Monthly rate for occupancy fee: 7-10% p.a.

- Maximum term of each individual investment: 10 years

- Maximum equity share ownership: 20%

- Each individual homeowner has a credit assessment approved by a home loan lender.

- The home loan lenders are banks that operate in Australia under APRA.

- Platform has track record of over 25 homes

The Fund will seek to undertake investments into equitable interest of residential properties with the following investment criteria:

Your Path to Alternative Investments Starts Here

Join thousands of Australians unlocking the potential of fractional investing with Assetora. Whether you’re investing individually, as part of a group, or through a tax-efficient structure like an SMSF, our platform provides the flexibility, transparency, and support to help you build and diversify your portfolio.